Why Network Function Virtualization (NFV)?

I want to give you some background on the growing case for NFV by sharing a few quotes from Rajesh Ghai, the research director of carrier network infrastructure at IDC, a leading market research firm. In his December 2017 report, Rajesh made a point that there is a strong business case that exists for Network Functions Virtualization at the network edge. The big takeaway is that IDC looks at the market, the dynamics, and at future revenue and says, "This is real, there's a business case." Rajesh goes on to say, "While they are short-term business benefits in the form of lower acquisition cost, the long-term business case truly rests on the advantages that accrue from simplicity, flexibility, and agility - from being able to deploy a service or a network service." What we need to understand from the start is that NFV is not a technology that's looking for a use case. This actually has valid business case reasons, it's happening now and it's happening because it makes business sense for operators to move to NFV.

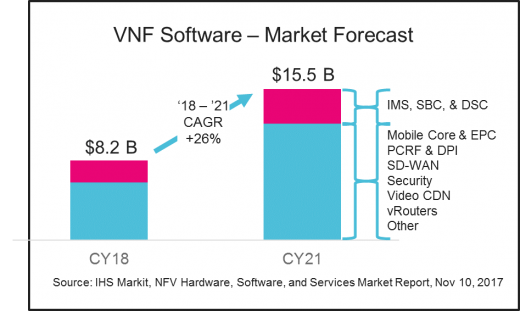

How big is the NFV market and what's really happening out there? As shown in Figure 1, IHS Markit (NFV Hardware, Software, and Services Market Report, Nov 10, 2017) predicted that Virtual Network Functions (VNF) software will be a 15.5 billion dollar market by 2021. However, that does not include VNF services that are associated with implementing VNF and it doesn't include hardware (because the hardware is still needed in data centers to complement VNFs). This represents only software. The IHS report takes a look at multiple VNF categories. One of these categories, "IMS, SBC, and DSC", at the top of each bar, is predicted to grow at an approximately 25 percent Compound Annual Growth Rate (CAGR) between 2018 and 2021. Two to four years ago, this market was still in its very early stage. But since last year, it has gone through a significant uptick and what we see is it's not only in the middle of an uptick, but there's a real transformation taking place between deploying physical and virtual Session Border Controllers (SBCs).

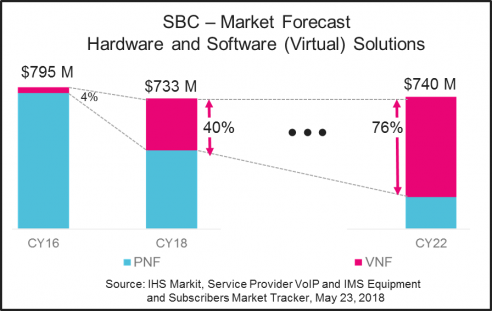

Figure 2, also from IHS Markit’s Service Provider VoIP and IMS Equipment market tracker from May 2018, the SBC market and transformation is represented by purpose-built, custom hardware or general purpose servers in a traditional physical environment (blue) and virtual network functions that are software-only SBCs that run on general purpose servers capable or running under hypervisor control (red). IHS Markit estimates a small (about 8 percent) drop in revenue between 2016 and 2018; however, within that same time period the percentage of VNF SBCs is projected to grow from a very small 4 percent to 40 percent of total service provider SBC market. The projected growth continues through 2022 when the percentage of virtual SBCs is projected to overtake physical SBCs.

The data clearly points to strong market growth and a very positive business case for Virtual Network Functions (VNFs). If you are not already thinking about VNFs, our webinar, “Optimize Real-time Communications with Cloud-native SBC”, will provide the essential elements to begin your journey, and if you are already thinking about VNFs, the webinar will illustrate strategic ways to move forward.

Watch a replay of this webinar, “Optimize Real-time Communications with Cloud-native SBC today!

*Source: IHS Markit, Technology Group. Data are not an endorsement of Ribbon. Any reliance on these results is at the third party’s own risk. Visit technology.ihs.com for more details.