SONUS AND GENBAND TO COMBINE TO CREATE A GLOBAL LEADER IN REAL-TIME COMMUNICATIONS SOFTWARE SOLUTIONS

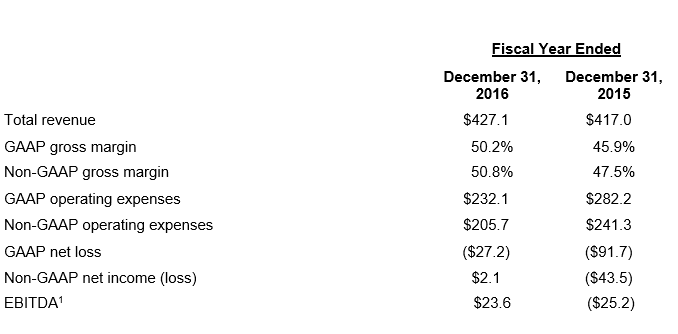

Companies’ Combined 2016 Revenue was approximately $680 Million and EBITDA was $50 Million

Expected to be Substantially Accretive to Sonus’ Non-GAAP EPS in 2018 and Generate Significant Cash Flow from Operations Post-Close

Projected Annual Cost Synergies of $40-$50 Million by the End of 2018

At Least $100 Million in Annual EBITDA Expected Following Full Impact of Annualized Synergies; Fiscal Year 2020 Projected EBITDA to be approximately $140 Million

Enhanced Scale and Geographic Reach and Highly Complementary Product Portfolios Expected to Enable Expanded Market Opportunities to Accelerate Growth and Drive Shareholder Value

For Immediate Release: May 23, 2017

WESTFORD, MA and PLANO, TX – Sonus Networks, Inc. (Nasdaq: SONS) (“Sonus”), a global leader in securing cloud and real-time communications, and GENBAND™, a leading provider of carrier and enterprise network transformation and real-time communications solutions, today announced a definitive agreement under which the two companies will combine to create a leader in next-generation communications networking, with increased scale and market reach across products, customers and geographies. Sonus and GENBAND shareholders will each own approximately 50% of the combined company. Based on the closing price of Sonus’ common stock on May 22, 2017 of $7.79 and estimated net cash at the time of closing, the transaction values the combined company at an enterprise value of approximately $745 million.

Ribbon Enterprise SBCs (Formerly Sonus)

MS Teams Direct Routing for Dummies

The transaction combines Sonus’ software-based leadership position in real-time communication virtualization, cloud-based session initiation protocol (SIP) and 4G/voice-over LTE solutions and security initiatives with GENBAND’s network modernization, unified communications, and mobility and embedded communications solutions. Together, Sonus and GENBAND will be better positioned to enable network transformations to IP and cloud-based networks for communication service providers and enterprise customers worldwide, with a broader and deeper global sales footprint, increased ability to invest in growth, more efficient and effective R&D, and a comprehensive real-time communications product offering.

The two companies’ combined 2016 revenue and EBITDA would have been approximately $680 million and $50 million, respectively, on a combined basis which excludes synergies and is prior to any impact from purchase accounting. The transaction is expected to be substantially accretive to Sonus’ earnings per share in 2018. The combined company is expected to realize annual cost synergies of $40 million to $50 million by the end of 2018 and to drive solid cash flow from operations in the first year after closing. Following the full impact of expected annualized synergies, the combined company is expected to generate at least $100 million in annual EBITDA, with fiscal year 2020 EBITDA projected to be approximately $140 million.

Management Comments

“Together, Sonus and GENBAND create a market leader in real-time communications with enhanced capabilities to support our customers’ move to cloud-based solutions,” said Raymond Dolan, President and Chief Executive Officer of Sonus. “The transaction is expected to generate significant near- and long-term value for shareholders, who we believe will benefit from their ownership in a combined company with increased scale and resources to invest in and accelerate each company’s growth initiatives. This is a strategically and financially compelling transaction for Sonus and we are confident that together with GENBAND we will achieve our growth initiatives faster and more fully than either company could do on its own.”

Mr. Dolan continued, “GENBAND has an outstanding reputation in the market with a talented team and products that are highly complementary to Sonus. We are excited to combine forces to provide enhanced reliability, performance and functionality for customers’ real-time communications needs.”

David Walsh, Chief Executive Officer and Chairman of GENBAND, said, “We are delighted to combine with Sonus at a time when the world’s largest service providers and enterprises accelerate the modernization and transformation of their networks. Like Sonus, GENBAND has transitioned its business to support this industry shift and we have seen improving profitability over the last couple of years and into 2017. With this combination, we believe our complementary product portfolios and expanded global footprint will allow us to even better respond to the evolving needs of customers. Our heritage and culture fit perfectly together and the combined talent going forward is second to none. This is truly an ideal combination.”

Transaction Details

Under the terms of the agreement, Sonus and GENBAND will combine under a newly formed holding company. Each Sonus shareholder will receive one share of common stock in the combined company for each existing Sonus share they own. The combined company will issue approximately 50 million shares of common stock to GENBAND’s equity owners as well as $22.5 million of consideration in the form of an unsecured note. Upon closing of the transaction, Sonus and GENBAND shareholders are each expected to own approximately 50 percent of the combined company on a fully diluted basis. The combined company will have an estimated net cash position of $40 million to $45 million at the time of close, which is expected to increase meaningfully in fiscal 2018 as the company realizes synergies.

The transaction has been unanimously approved by the Boards of Directors of both companies, and is expected to close in the second half of 2017, subject to Sonus and GENBAND shareholder approval, listing of the combined company’s common stock on Nasdaq, Hart-Scott-Rodino review, and other customary closing conditions.

Management and Board

The Chief Executive Officer of the combined company will be Mr. Dolan. Mr. Walsh will oversee the Kandy business, a division of the combined company and currently GENBAND’s cloud communications platform as a service (CPaaS) for global service providers and enterprises. Mr. Walsh will also assist with the integration of the businesses. Daryl Raiford, Chief Financial Officer of GENBAND, will serve as Chief Financial Officer of the combined company. The remainder of the leadership team will be named from the current leadership of both companies, and will be announced prior to closing.

The Board of Directors of the combined company will have five representatives designated by GENBAND and four representatives designated by Sonus. Sonus’ designees will include Richard Lynch, current Chairman of Sonus and former Chief Technology Officer of Verizon, who will serve as Chairman, and Mr. Dolan. The full board composition will be announced in the near future.

Strategic Benefits

- Complementary Strengths and Strategies: Both companies have pursued complementary strategies to enable network transformation for their customers. Sonus has concentrated on providing next generation cloud-based SIP and 4G/VoLTE solutions by providing network layer control, security, interworking, policy, and session management for the delivery of real-time communications. GENBAND’s strategy is centered on seamlessly supporting its robust and long-term customer base of carriers and enterprises to modernize their network to IP with a broad product portfolio that includes soft switches, media gateways, and application servers, and leveraging that IP infrastructure with a rapid service creation capability. The combined company will have little product overlap and will be well-positioned to deliver comprehensive solutions to service providers and enterprises migrating to a virtualized all-IP world.

- Expanded Reach and Geographic Footprint: Together, the combined company will have a global sales footprint in 27 countries. 67% of the combined 2016 revenues from the two companies were generated in the U.S. and Canada, 18% in EMEA, 11% in APAC and 4% in CALA. Together, Sonus and GENBAND will have a global presence, serving nearly every major Tier-1 communications service provider.

- Complementary Growth Initiatives: Both companies have established growth initiatives that are highly complementary. GENBAND’s Kandy initiative enables service providers and other market participants to embed voice, video, messaging, chat, presence and more into any business process or application, enhancing outcomes for business, consumer and Internet of Things deployments. The Kandy CPaaS allows customers to rapidly create new revenue streams for customers/partners. Sonus’ new offering is a cloud security and analytics platform for real-time flows and digital services. This security offering provides end-to-end visibility and analytics enabling network-wide flow control, threat detection and mitigation. These combined growth initiatives aim to create the path for customers/partners to quickly and securely launch new real-time communications offerings.

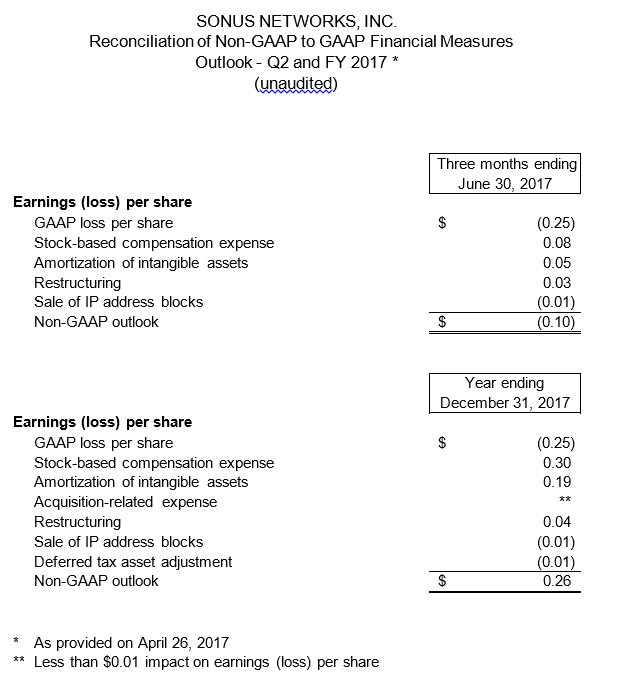

Sonus Reconfirms its Q2 2017 and Full Year 2017 Outlook

Sonus reconfirms its 2017 second quarter and full year outlook, as previously provided on April 26, 2017. Diluted earnings per share and loss per share are presented on both a GAAP and non-GAAP basis. A reconciliation of the non-GAAP to GAAP outlook and a statement on the use of non-GAAP financial measures are included at the end of this press release.

Q217

- Revenue of approximately $54 million

- GAAP loss per share of approximately $0.25

- Non-GAAP loss per share of approximately $0.10

First Half 2017

- Revenue of approximately $107 million

Fiscal 2017

- Flat to low single digit revenue growth versus prior year

- Non-GAAP diluted earnings per share of $0.26, which equates to a GAAP loss per share of $0.25

Sonus intends to update its guidance to include GENBAND following the close of the transaction, which is expected to occur in the second half of 2017.

GENBAND Historical Financial Results:

The following table summarizes the consolidated annual financial results of GENBAND (in millions):

[1] EBITDA represents earnings before interest, taxes, depreciation, amortization and certain other expenses.

Advisors

Evercore served as Sonus’ financial advisor and Wilmer Cutler Pickering Hale and Dorr LLP served as Sonus’ legal advisor. Guggenheim Securities and J.P. Morgan Securities LLC served as GENBAND’s financial advisors and Latham & Watkins LLP served as GENBAND’s legal advisor.

Conference Call Details

There will be a conference call hosted by Mr. Dolan and Mr. Walsh.

Date: Today, May 23, 2017

Time: 8:30 a.m. (ET)

Dial-in number: 800-786-7015

International Callers: +1-303-223-0117

There will be a live, listen-only webcast of the conference call via the Sonus Investor website at http://investors.sonusnet.com/events.cfm where supporting materials, including a presentation, have been posted.

Replay Information

An archived version of the broadcast will be available on the Sonus Investor website shortly after the conclusion of the live event. A telephone playback of the call will be available following the conference call and can be accessed by calling 800-633-8284 or +1-402-977-9140 for international callers. The reservation number for the replay is 21852768.

About Sonus Networks

Sonus brings intelligence and security to real-time communications. By helping the world embrace the next generation of Cloud-based SIP and 4G/LTE solutions, Sonus enables and secures latency-sensitive, mission critical traffic for VoIP, video, instant messaging and online collaboration. With Sonus, enterprises can give priority to real-time communications based on smart business rules while service providers can offer reliable, comprehensive and secure on-demand network services to their customers. With solutions deployed in more than 100 countries and nearly two decades of experience, Sonus offers a complete portfolio of hardware-based and virtualized session border controllers (SBCs), diameter signaling controllers (DSCs), policy/routing servers, network intelligence applications, media and signaling gateways and network analytics tools. For more information, visit www.Sonus.net or call 1-855-GO- Sonus.

About GENBAND

GENBAND is a global leader in real-time communications software solutions for service providers, enterprises, independent software vendors, systems integrators and developers in over 80 countries. The company’s Network Modernization, Unified Communications, Mobility and Embedded Communications solutions enable its customers to quickly capitalize on growing market segments and introduce differentiating products, applications and services. GENBAND’s market-leading solutions, which are deployable in the network, on premise or through the cloud, help its customers connect people to each other and address the growing demands of today’s consumers and businesses for real-time communications wherever they happen to be. GENBAND’s award-winning Marketing Advantage Program offers partners free resources, training and campaigns to fuel their success in implementing GENBAND powered services. To learn more visit GENBAND.com.

IMPORTANT INFORMATION ABOUT THE TRANSACTION WILL BE FILED WITH THE SEC

In connection with the proposed transaction, Sonus will cause Solstice Sapphire Investments, Inc., a wholly-owned subsidiary of Sonus formed to act as a holding company in connection with the transaction (“NewCo”), to file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement of Sonus and GENBAND and certain of its affiliates (the “GENBAND Parties”) and a prospectus of NewCo and Sonus and the parties may file with the SEC other relevant documents concerning the proposed transaction. Sonus will mail the joint proxy statement/prospectus to the Sonus stockholders and the GENBAND Party equity holders. SONUS STOCKHOLDERS AND GENBAND PARTY EQUITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus (when available) and other filings containing information about Sonus at the SEC’s website at www.sec.gov. The joint proxy statement/prospectus (when available) and the other filings may also be obtained free of charge from Sonus’ Investor Relations website (http://investors.sonusnet.com/) or by requesting them from Sonus’ corporate secretary at Sonus Networks, Inc., 4 Technology Park Drive, Westford, Massachusetts 01886, Attention: Corporate Secretary.

Sonus, NewCo, the GENBAND Parties and certain of their respective directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Sonus stockholders in connection with the proposed transaction. Information about the directors and executive officers of Sonus and their ownership of Sonus common stock is set forth in the proxy statement for Sonus’ 2017 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 28, 2017.

Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available. Free copies of this document may be obtained as described in the preceding paragraphs.

NO OFFERS OR SOLICITATIONS

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements”—that is, statements related to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the expected performance of the combined companies. Uncertainties that could cause actual results to be materially different than those expressed in Sonus’ and the GENBAND Parties’ forward-looking statements include the failure to consummate the proposed transaction or to make or take any filing or other action required to consummate such transaction in a timely matter or at all. These or other uncertainties may cause actual future results to be materially different from those expressed in Sonus’ and the GENBAND Parties’ forward-looking statements. These risks and uncertainties include, but are not limited to, economic, competitive, legal, governmental and technological factors. Accordingly, there is no assurance that the expectations of Sonus or any GENBAND Party will be realized. Many factors could cause actual results to differ materially from these forward-looking statements with respect to the proposed transaction, including risks relating to the completion of the proposed transaction on anticipated terms and timing, including obtaining equity holder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, the ability of Sonus and the GENBAND Parties to integrate the business successfully and to achieve anticipated synergies, potential litigation relating to the proposed transaction, and the risk that disruptions from the proposed transaction will harm Sonus’ or the GENBAND Parties’ business. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Sonus’ or the GENBAND Parties’ consolidated financial condition, results of operations or liquidity. Neither Sonus nor any GENBAND Party assumes any obligation to provide revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws.

DISCUSSION OF NON-GAAP FINANCIAL MEASURES

Sonus management uses several different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of the business, making operating decisions, planning and forecasting future periods, and determining payments under compensation programs. Our annual financial plan is prepared both on a GAAP and non-GAAP basis, and the non-GAAP annual financial plan is approved by our board of directors. Continuous budgeting and forecasting for revenue and expenses are conducted on a non-GAAP basis (in addition to GAAP) and actual results on a non-GAAP basis are assessed against the annual financial plan. We consider the use of non-GAAP financial measures helpful in assessing the core performance of our continuing operations and liquidity, and when planning and forecasting future periods. By continuing operations, we mean the ongoing results of the business excluding certain expenses and credits, including, but not limited to: stock-based compensation, amortization of intangible assets, acquisition-related expense, restructuring, certain gains included in other income (expense) and a deferred tax asset adjustment. We consider the use of non-GAAP earnings (loss) per share helpful in assessing the performance of the continuing operations of our business. While our management uses non-GAAP financial measures as a tool to enhance their understanding of certain aspects of our financial performance, our management does not consider these measures to be a substitute for, or superior to, GAAP measures. In addition, our presentations of these measures may not be comparable to similarly titled measures used by other companies. These non-GAAP financial measures should not be considered alternatives for, or in isolation from, the financial information prepared and presented in accordance with GAAP.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, many of the adjustments to Sonus’ financial measures reflect the exclusion of items that are recurring and will be reflected in our financial results for the foreseeable future.

Stock-based compensation is different from other forms of compensation, as it is a non-cash expense. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and the cost to us is based on a stock-based compensation valuation methodology and underlying assumptions that may vary over time. We believe that excluding non-cash stock-based compensation expense from our operating results facilitates the comparison of our financial statements to our historical operating results and to other companies in our industry.

We exclude the amortization of acquired intangible assets from non-GAAP expense and income measures. These amortization amounts are inconsistent in frequency and amount and are significantly impacted by the timing and size of acquisitions. Although we exclude amortization of acquired intangible assets from our non-GAAP expenses, we believe that it is important for investors to understand that intangible assets contribute to revenue generation. We believe that excluding the non-cash amortization of intangible assets facilitates the comparison of our financial results to our historical operating results and to other companies in our industry as if the acquired intangible assets had been developed internally rather than acquired.

We consider certain transition, integration and other acquisition-related costs to be unpredictable and dependent on a significant number of factors that may be outside of our control. We do not consider these acquisition-related costs to be related to the continuing operations of the acquired business or the Company. In addition, the size, complexity and/or volume of an acquisition, which often drives the magnitude of acquisition-related costs, may not be indicative of such future costs. We believe that excluding acquisition-related costs facilitates the comparison of our financial results to our historical operating results and to other companies in our industry.

We have recorded restructuring expense to streamline operations and reduce operating costs by closing and consolidating certain facilities and reducing our worldwide workforce. Additionally, as previously announced, we expect to record restructuring expense in connection with new restructuring initiatives over the next twelve months. We review our restructuring accruals regularly and record adjustments (both expense and credits) to these estimates as required. We believe that excluding restructuring expense and credits facilitates the comparison of our financial results to our historical operating results and to other companies in our industry, as there are no future revenue streams or other benefits associated with these costs.

We expect to complete the sale of IP address blocks acquired in connection with our 2012 acquisition of Network Equipment Technologies, Inc. in the second half of 2017, and accordingly, have included a gain of $0.6 million in our outlook for the full year 2017. This gain will be included as a component of Other Income, net. We believe that such gains are not part of our core business or ongoing operations. Accordingly, we believe that excluding the other income arising from this sale facilitates the comparison of our financial results to our historical results and to other companies in our industry.

We anticipate that we will reverse $0.7 million of deferred tax assets related to net operating loss carryforwards for our subsidiary in Canada based on positive earnings evidence in the subsidiary over a consecutive three-year period. This adjustment will result in an income tax credit and reduce our provision in the reversal period. We believe that such adjustments are not part of our core business or ongoing operations. Accordingly, we believe that excluding the income tax credit arising from the reversal of the deferred tax assets facilitates the comparison of our financial results to our historical results and to other companies in our industry.

We believe that providing non-GAAP information to investors, in addition to the GAAP presentation, will allow investors to view the financial results in the way management views the operating results. We further believe that providing this information helps investors to better understand our financial performance and evaluate the efficacy of the methodology and information used by our management to evaluate and measure such performance.

Contact Information

Sonus