Voice is Still the “Killer App” and Here’s Why

We’ve been on an uphill trajectory with Voice-over-IP (VoIP) since the 1990s, and as the industry continues to improve the quality, predictability and economics of packetized voice sessions, there is no end in sight when it comes to growth. However, growth in the future will be driven more by innovation in applications and embedding voice, messaging and video into enterprise productivity applications, contact center platforms, web experiences and mobile apps, rather than by the initial spark – replacing switched voice with VoIP to reduce costs.

Today, we see “value creation” in VoIP-based and especially cloud-based real time communications software and Communications Platform as a Service (CPaaS) offerings, which are making the blending of sessions easier to perform. As is often the case with disruptive technologies, the transition to VoIP will still be largely powered by a convergence of falling costs and rising demands, but the demands are surfacing in different ways.

In our “instant gratification” culture, we increasingly don’t want to have to dial a “phone number” when we have a question. Instead, we want to tap once to get an answer from a human expert - within the moment, within the context. Phone numbers are still valuable as a unique addressing scheme, which can be clearly seen in the use of Over the Top apps like Facetime and WhatsApp.

While Communications Service Providers (CSPs) have driven a huge amount of profitable revenue growth by helping small and medium enterprises save as much as half by moving off time-division multiplexing (TDM) to VoIP-based services, that cost savings actually turned out to be productivity gains, as more and more employees moved to mobile and even mobile-only voice sessions.

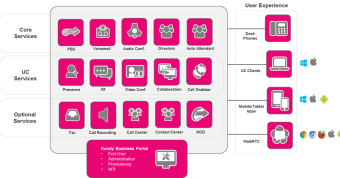

Offices with fixed landline phones only are becoming increasingly outdated. More and more businesses are operating remotely, using laptops and smartphones, and even in the office – not only for voice but for converged email, IM, collaboration, and more.

This shift to a more mobile workforce is creating a wide demand for more VoIP-based communication and collaboration platforms. With the capability to initiate calls over wireless and cellular networks, VoIP solutions that meet the needs of the mobile workforce are more available and affordable than ever, which is a huge contributor to market growth.

Growth in VoIP is also driven by emerging countries with no fixed or very little infrastructure. Instead, countries with the largest population, like China and India, are investing in Internet access and broadband, and overlaying private networks that leverage VoIP – making start-ups to massive enterprises more competitive locally and globally.

With more and more bandwidth available at less expensive price and the advent of 4G and 5G networks, quality as a premium service is becoming easier to deliver.

From deep pocket investment to deep packet inspection, billions of dollars moved over to VoIP-powered services and applications, and after a great two-decade run, the fun isn’t over yet.

Technavio suggests that VoIP will grow at a rate of 9.87% through at least 2021. The report also pointed out three factors that move business VoIP into the next stage of its life-cycle:

- The increasingly mobile workforce

- BYOD as the new normal

- Greater coverage by 3G/4G/5G hotspots

Growth Is Inevitable; CSPs Must Be Prepared

According to the FCC, in December 2016, there were 58 million end-user switched access lines in service and 63 million interconnected VoIP subscriptions in the US alone, making VoIP 52% of wireline total.

It's taken around twenty years since IP-telephony emerged to reach the majority of subscriptions. There's still growth ahead with tens of millions of customers that can shift from legacy to VoIP solutions.

The FCC uses Form 477 to collect subscribership information from providers of voice telephone services – the incumbent local exchange carriers (ILECs), competitive local exchange carriers (CLECs), interconnected VoIP service, and mobile voice providers.

What this doesn't capture is the usage of peer-to-peer applications and embedded communications (e.g., a Slack call between users) that are not interconnected to the public switched telephone network (PSTN).

The FCC’s report also revealed that nearly 1,700 providers offer fixed phone service, up from 1,644 in previous years. And 62% of those providers offer VoIP.

Even with industry consolidation, and as VoIP becomes more commoditized, while some companies exit the business, the VoIP service provider universe is still growing.

After twenty years, the VoIP market is still on a rise and with 58 million end-user switched access lines, there are clearly more fixed lines to transform.

Frost & Sullivan expects the hosted IP telephony and UCaaS market to more than double in terms of seats from 2017 to 2020. The rumors of VoIP’s demand seem to be greatly exaggerated and these are just a few reasons why “Voice” is still the “Killer App”.