Telco 2.0™, ICT and the Exchange of Everything in the Digital Economy

The business model of Communication Service Providers (CSP), traditionally known as telcos, is under attack on multiple fronts. For decades, the telco business model has been one-sided: telcos provide services to consumers in a completely unidirectional paradigm where they define the offering and consumers can take it or try and find another one-sided competing offer.

This model has worked well for a considerable amount of time. Telcos were expected to come up with services and features (voice, messaging, business services, mobility) and consumers used them for their communications needs. This focused competition mainly around bundling and pricing. But the arrival of the internet, the proliferation of mobile platforms and the democratization of broadband access has paved the way for other players to aggressively enter the market, players that are using the very networks the telcos deployed to provide voice, video, messaging and all sorts of value-added services to the telco user base. And these players are leveraging the cloud business models to provide rich and extremely focused user experiences with an agility and cost structure beyond the ability of traditional CSPs.

All of these disruptive over-the-top (OTT) applications have a common denominator: the integration of information and communication technologies (ICT) into our daily processes and activities as a way to facilitate the connection between users on one side and information and providers of goods and services on the other side, ushering in the digital economy.

While all of this was happening, many CSPs were still focusing on a unidirectional business model that was based mostly on transport of voice and data and, year over year, they saw their value added services revenue declining. As a result, CSPs dominance in the value chain is being severely tested and they run the risk of being relegated to mere “carriers” in the most literal meaning of the word, with a business that is perceived as a commodity and where margins and profitability are much lower.

Telco 2.0 and the Move to the Two-sided Business Model

The two-sided business model is not a new thing, it has existed for many decades, even before the CSPs that we know today were created. In a two-sided model, the business doesn’t focus on providing goods or services to end users. Instead, the business becomes a mediator, a broker, that connects the providers of goods or services with the consumers, and takes a commission for it.

This model has worked in many different industries. The first example is a farmer’s market. Here the owner of the venue connects farmers with consumers for a fixed fee - the rent that the farmer pays to set up the stall during market days. This fixed fee ensures the venue owner always makes money, regardless of the success of the tenants, however, lower risk means lower profit. If tenants are extremely successful, the market’s owner does not profit from it.

The stock market is another example of the two-sided model. Here investors and companies are interconnected by brokers to allow shares to be sold and bought. All for a small percentage on the transaction–– nominal for the investors, but it quickly adds up as the volume of transactions increases.

There are also other relevant examples. GENBAND’s CEO David Walsh recently unveiled the concept of the Exchange-of-Everything at the Perspectives16 summit. The Exchange of Everything encompasses a world where the Internet of Things (IoT) and Real-Time Communications (RTC) intersect into a completely disruptive realm. During his presentation he used several illustrative examples of this two-sided business model. Uber is the largest taxi company in the world, and yet they don’t own any cars. Similarly, Airbnb is the largest tourist lodging company in the world and they don’t own any hotel rooms or apartments. Mr. Walsh highlighted how new supply chains are being built everywhere and we don’t have to be physically located in a place anymore to use them.

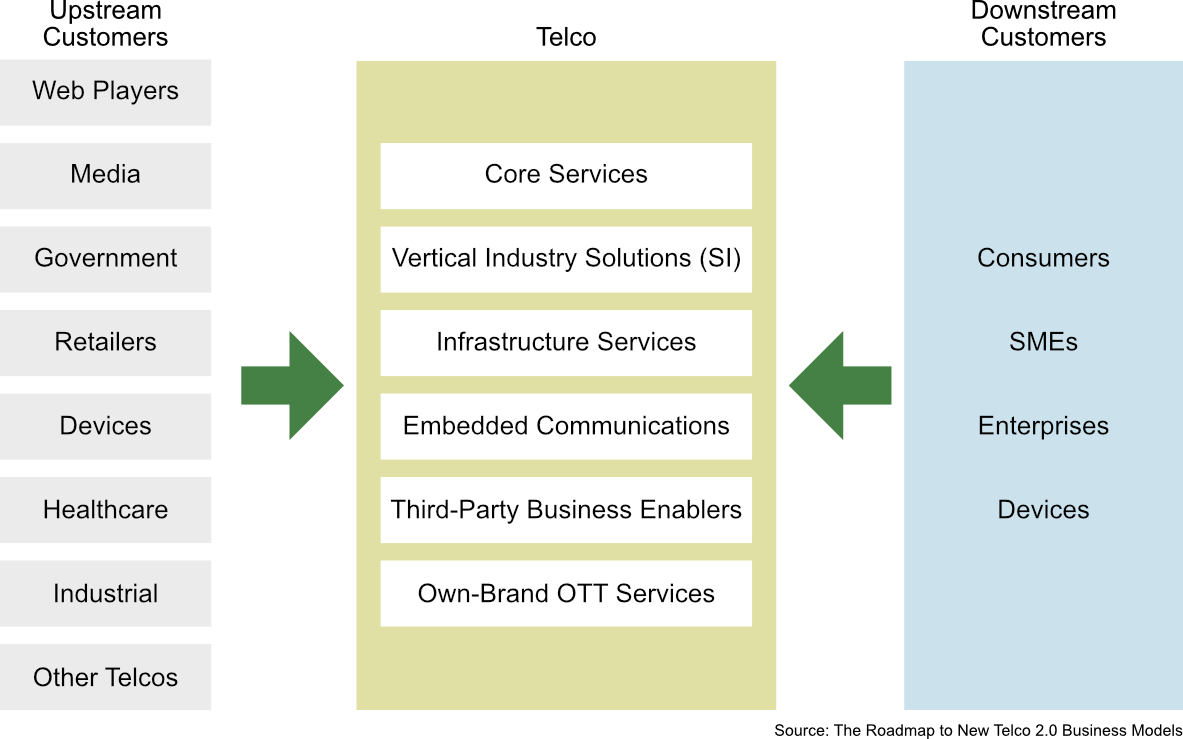

The Telco 2.0 concept is all about enabling these supply chains, about executing the move from the one-sided businesses––where the CSP provides services and the users consume them––to a two-sided model where information and communication technologies (ICT) and applications become the platform to interconnect multiple providers (upstream customers) with different users (downstream customers). A model where the CSP becomes the broker that allows them to exchange services, information or even goods.

CSPs are strategically positioned to become this broker. They have a wealth of user data that can be leveraged to provide value to both sides of the model:

- Personal information – address, gender, name, profile, preferences

- Device Information – SIM/softSIM, mobile OS, capabilities

- Subscriber Identity – phone number, IP Address, SIP address

- Context – location, presence, roaming status

- Relationships – workplace, friends, bank, school…

Not only do the CSPs own all of this valuable data, but they are the only players that have the breadth of capabilities to become the broker in the Exchange-of-Everything:

- Identity, Authentication and Security – the phone number is a powerful tool for authentication and most OTT applications are using two-factor authentication to strengthen their security by sending a code to a mobile phone number owned by the CSP.

- Advertising, Marketing & Business Intelligence – CSPs have the teams, the tools and the information required to better connect providers with consumers and they have decades of experience doing it.

- Content Distribution – CSPs own the transport networks that OTTs are using today, the fiber, copper, coaxial and wireless broadband networks.

- Billing and Payments – CSPs have a strong billing relationship with the subscriber and, in an age where credit card number leak scandals happen all too often, they are uniquely positioned to become a payment broker (in fact, some of them already allow users to buy content from online stores like Google Play by charging it directly to their mobile bill).

- (Voice-based) Customer Care – CSPs have the experience, the teams and the tools to provide customer care - taking advantage of the economies of scale to provide an outsourced customer care service at a competitive cost to their upstream customers.

All the user data and the capabilities above provide CSPs with the ability to better marry their upstream and downstream customers. It is their unique value and something from which they can gain a profitable competitive advantage.

The biggest issue, however, is that although CSPs have a comprehensive set of core services, most of them still haven’t deployed the rest of the elements on the value chain. Many of them are still hoping that their IMS investment can be the enabler for some of those elements––and building all those capabilities require time and money in an inversely proportional relationship: the less money you invest, the more time it requires and vice versa.

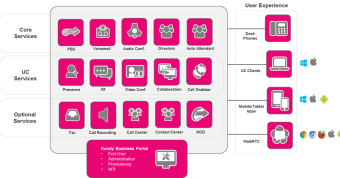

The good news is that CSPs don’t have to build it all from scratch. Communications Platform-as-a-Service (cPaaS) providers, such as Kandy, can open the shortcut to the Telco 2.0 model by complementing the core services provided by the CSP with APIs, SDKs, pre-built applications and tools that enable the CSP to take back their position as the dominant player in the value chain.

.png)

By leveraging a cPaaS solution such as Kandy, CSPs accelerate the evolution to Telco 2.0 by reducing, and sometimes eliminating, the technology risks with services and capabilities that are paid via a consumption model, in opposition to the traditional model of heavily investing CAPEX into network equipment and then trying to recover the cost by providing services from it. Kandy allows CSPs to consume the services and capabilities they require with a convenient OPEX-based cost structure that can be marked up with a competitive margin to provide a profitable business model.

Kandy helps CSPs build their upstream capabilities and enhance their downstream relationships with unique user experiences that are immersive, in context and embedded into the users’ workflow. It is the right time to embrace the OTT model and fiercely compete for a big piece of the lucrative Exchange-of-Everything.